W4 Multiple Jobs Worksheet Reddit. This can underpay in many situations, because the withholding fills up roomier withholding brackets (so to speak) than your actual married tax brackets. This option is accurate for jobs with similar pay;

With multiple jobs, if the second job makes more then 4k, you need to file single 0 for both, with an additional amount withheld. This option is accurate for jobs with similar pay; Fill out the multiple jobs worksheet.

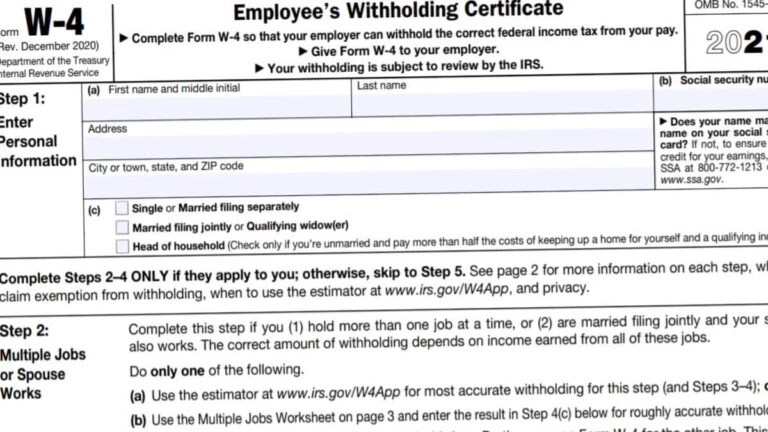

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Jobs Worksheet Tax Refund.

Tackling your form w 4 as you start a new job uploaded by admin on wednesday, november 4th, 2020 in category printable multiplication. Or (c) if there are only two jobs total, you may check this box. If you had a job and changed jobs then you should fill out the irs form w4 as two jobs.

With Multiple Jobs, If The Second Job Makes More Then 4K, You Need To File Single 0 For Both, With An Additional Amount Withheld.

The only two steps required for all employees are step 1, where you enter personal information like your name and filing status, and step 5, where you sign the form. If you choose option b in step 2, you will need to complete the multiple jobs worksheet. If you have two jobs.

You Do Not Need To Complete The Two Earners/Multiple Jobs Worksheet.

The thing for w4s are just an estimate for how much tax you want to withhold. In the multiple jobs worksheet question 2, it references table 1 stating that you should enter 3 if the highest paid member of your family makes less then $65k. Just fill out the form and follow the instructions:

The Reason Multiple Jobs Screws Up Withholding Is Each Job Considers A Certain Amount Of Your Income Not Taxable, Then Uses Tax Bracket Sizes Based On Whether Single Or Married Is Chosen.

This can underpay in many situations, because the withholding fills up roomier withholding brackets (so to speak) than your actual married tax brackets. Fill out the multiple jobs worksheet. Multiple jobs and deductions worksheet.

Be Sure To Have Information Regarding Your Income, Dependents And Any Additional Items Worth Valuable Deductions And Credits, Including Education Expenses And Itemized.

So use the online irs tax estimator or the multiple jobs worksheet. If you have multiple jobs or a spouse that also works, you would go to page 3 step 2 (b) multiple jobs worksheet and work through the section to determine if you need additional taxes withheld from your paycheck. Use this worksheet only if the instructions under line h on page 1 direct you here.