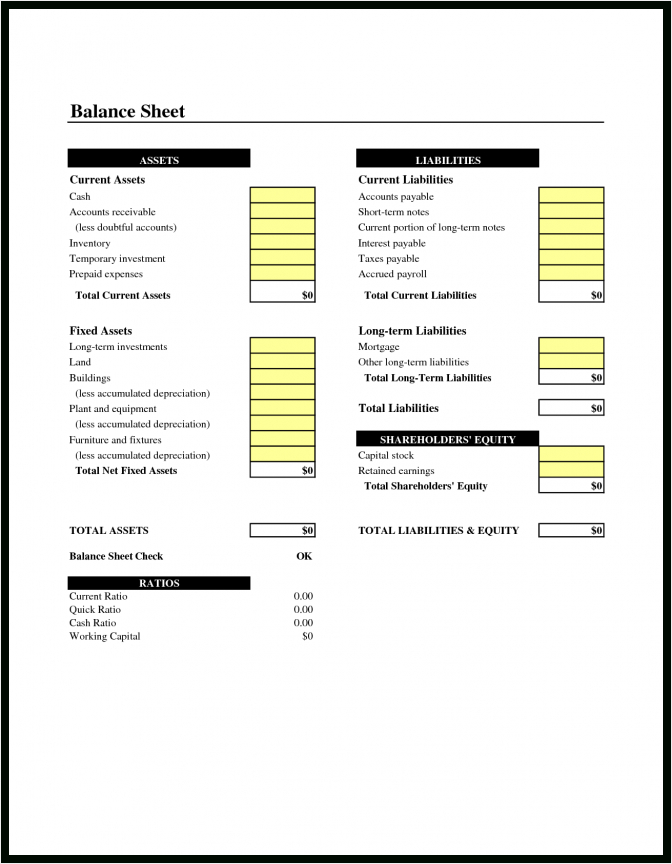

These are values that come from the Details worksheet. A balance sheet provides a summary of financial health in a single brief report.

Excel Spreadsheet For Accounting Of Small Business And Intended For Small Business Balan Balance Sheet Template Excel Spreadsheets Templates Excel Spreadsheets

One of the most critical components of GAAP is the accrual-basis accounting method which states that companies should recognize revenues and expenses at the time of a.

Small business assets and liabilities worksheet. Once you complete the list evaluate it to determine which option is best for putting personal money into your business. On the balance sheet total assets will equal the total of liabilities plus the owners equity. The assets and the liability statement templates sometimes involve the fund net asset which is the asset subtracting the.

These tips offer guidelines on depreciating small business assets for the best tax advantage. Equity is the remaining proportion of the owners financial interest in the business after deducting any liabilities from the total assets in the business. If your assets increase your liabilities and.

You can use our Assets and Liabilities Worksheet to assist. Yours may have slightly different categories depending on the type of business. Assets Liabilities Equity.

This simple balance sheet template includes current assets fixed assets equity and current and long-term liabilities. You have to deal with assets and liabilities that arent in the profits and loss statement and project your businesss net worth at the end of a fiscal year. Margin debt on stocks and other debt to purchase or secured by investment assets other than real property 14.

Assets include cash stock property plant or equipment anything the business owns. Total assets A Total liabilities and owners equity Total assets equals total liabilities plus owners equity or ALE Use this worksheet to prepare the balance sheet you will include in your business plan. An income statement depicts the revenue and expenses of a business.

Liabilities are your debts and other unpaid financial obligations. The balance sheet is based on the standard accounting equation. Assets are defined as resources that help generate profit in your business.

Liability is defined as obligations that your business needs to. You have some control over it. Small business owners should abide by the generally accepted accounting principles GAAP more on that below.

This example of a simple balance sheet is fully customizable and ready to print. In fact 59 of small business owners globally experienced cash flow issues in the past year up from 42 in 2018 and many have trouble managing outstanding receivables and paying suppliers. They include standard reports like the balance sheet income or profit and loss statements and cash flow statement.

The Blue Balance Sheet is perfect for the typical metrics associated with small business finances such as total assets total liabilities net worth tax obligations and more. Liabilities are what the business owes to outside parties eg. Click on the links labeled Schedule 1 or Schedule 2 to go directly to the spot on the Details worksheet for entering those assets.

Business debts including those owed as a sole proprietor or partner 13. Most small business sales take the legal structure of an asset sale which means the purchaser is buying the tangible and intangible things that make the. Because business assets such as computers copy machines and other equipment wear out you are allowed to write off or depreciate part of the cost of those assets over a period of time.

In particular the Adjusted Net Asset Method calculates the difference between a businesss assets including equipment property and inventory and intangible assetsand its liabilities. Owners equity can also be described as the net worth of the business assets minus liabilities. The instructions for Form 5305A-SEP have a worksheet you can use to determine whether the elective deferrals of your.

Equity is officially defined by IASBs Framework for preparation and presentation of financial statements is the residual interest in the assets of the entity after deducting. Your equity as owner would be 10000. While small business owners may feel confident they also admit to experiencing recent struggles with cash flow.

Business owners can use it to evaluate performance and. The words asset and liability are two very common words in accountingbookkeeping. Compile and estimate what money you will have on hand month by month including accounts receivable money owed to you inventory if you have it land buildings and equipment.

Other liabilities debts not included above 15. 4222 401k Plans for Small Businesses. An established business entity will have its assets and liabilities and will have enough history to create a profit loss PL statement.

Most small businesses do start a new worksheet and enter column headers for the date transaction description and a transaction number. With this balance sheet template you can assess the financial standing of a business by examining assets liabilities and equity. For example if you have a house and a car with a value of 100000 and you have a mortgage and car loan for 75000 your net worth is 25000.

Use a similar format to prepare pro forma projected. 3998 Choosing a Retirement Solution for Your Small Business. Add Business Assets Subtract Business Liabilities The final step of how to value a business is to account for business assets and liabilities that arent already included in the SDE.

Your plan must provide that in the case of any merger. Investors and creditors only have the financial integrity of the entrepreneur to go on. The asset means resources like cash account receivable inventory prepaid insurance investment land building equipment etcThe liabilities are the expenses like the account payable salary payable etc.

Investors andor lenders typically expect business owners to use personal assets to finance a startup and theyll want to see how much capital you have available from your personal finances. Total liabilities immediately before the cancellation. For example suppose assets are 20000 and liabilities are 10000.

Suppliers bank or business loans. However when a business is just starting it has no financial history and therefore nothing to base a statement on. Financial statements are written records of a businesss financial situation.

If you overwrite the formula youll need to fix it. Report on your assets and liabilities with this accessible balance sheet template. The assets and liabilities are the two sides of the coin.

It features 3 sheets Liability and Owners Equity Assets and Summary. Microsoft Excel spreadsheets are a great option for your small business accounting needs. Explore the video tutorials in this article to get started.

Consolidation merger or transfer of assets or liabilities. Liabilities can be calculated by eliminating the total equities from total assets or accumulating total current liabilities and total long-term liabilities. Your net worth is the difference between your assets and your liabilities so your financial statement will allow lenders to determine your net worth.

When deciding on the best funding option it helps to make a list of your assets liabilities income likely investors and your current credit score. List all your Liabilities. The personal financial statements should detail each persons assets and liabilities outside of the business and their personal net worth.

Blank Balance Sheet Openoffice Template Balance Sheet Template Balance Sheet Openoffice Templates

List Your Assets Vs Liabilities To Calculate Net Worth Word Problem Worksheets Personal Financial Statement Solving Linear Equations

Balance Sheet Assets And Liabilities Excel Spreadsheet For Etsy In 2021 Balance Sheet Excel Spreadsheets Templates Accounting Basics

Balance Sheet Template Are You Looking Or A Simple Balance Sheet Template In Ms Word Download This Balance Sh Balance Sheet Template Balance Sheet Templates

How To Make A Balance Sheet For A Small Business An Easy Way To Start Is To Download This Balance Sheet Business Template Balance Sheet Template Balance Sheet

What Is A Balance Sheet Small Business Accounting Bookkeeping Business Small Business Bookkeeping

Balance Sheet Template Balance Sheet Statement Template

Free Excel Bookkeeping Templates Bookkeeping Templates Bookkeeping Small Business Bookkeeping

Balance Sheet Everything About Investment Bookkeeping Business Accounting Classes Accounting Basics

Balance Sheet Blank Template Balance Sheet Balance Sheet Template Check And Balance

Yearly Comparison Balance Sheet Template For Excel Excel Templates Balance Sheet Template Balance Sheet Balance Sheet Reconciliation

New Personal Assets And Liabilities Template Excel Xls Xlsformat Xlstemplates Xlstempla Personal Financial Statement Financial Statement Statement Template

Pin By Jacque Line On Finance Investing Balance Sheet Template Balance Sheet Small Business Accounting

Balance Sheet Blank Template Balance Sheet Balance Sheet Template Check And Balance

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Personal Financial Statement

Balancesh Pdf Sample Balance Sheet For Small Business With Small Business Balance Sheet Templ Balance Sheet Template Personal Financial Statement Balance Sheet

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Balance Sheet Template Printable Worksheets

Balance Sheet Form Balance Sheet Template Balance Sheet Small Business Accounting

Monthly Balance Sheet Excel Template Balance Sheet Balance Sheet Template Templates Free Design