All forms are printable and downloadable. Qualified dividends and capital-gain tax worksheet is a helpful tool when calculating the tax that a company pays on their shares of stock.

Figure The Tax On The Amount On Line 7 If The Amount On Line 7 Is Less Than 100 000 Use The Taxtable To Figure The Tax If The Amount On Line 7 Is Course Hero

The 0 rate applies to amounts up to 2650.

2019 qualified dividends and capital gain tax worksheet. Qualified Dividends And Capital Gains Worksheet 2016. Qualified Dividends And Capital Gains Worksheet 2020. Irs Form 1040 Qualified Dividends Capital Gains Worksheet.

Keep for Your Records. Ad Track Clients Potential Tax Liability Find Tax Efficient Alternatives. Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly.

Click Forms in the upper right upper left for Mac and look through the Forms In My Return list and open the Qualified Dividends and Capital Gain Tax Worksheet. Emilijia Maneveska Getty Images Most people ever invest. For the Desktop version you can switch to Forms Mode and open the worksheet to see it.

Pick the web sample from the catalogue. Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g even if you dont need to file Schedule D. Capital Gains and Losses Attach to Form 1040 1040-SR or 1040-NR.

Use our library of forms to quickly fill and sign your HRblock forms online. Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below. Go to wwwirsgovScheduleD for instructions and the latest information.

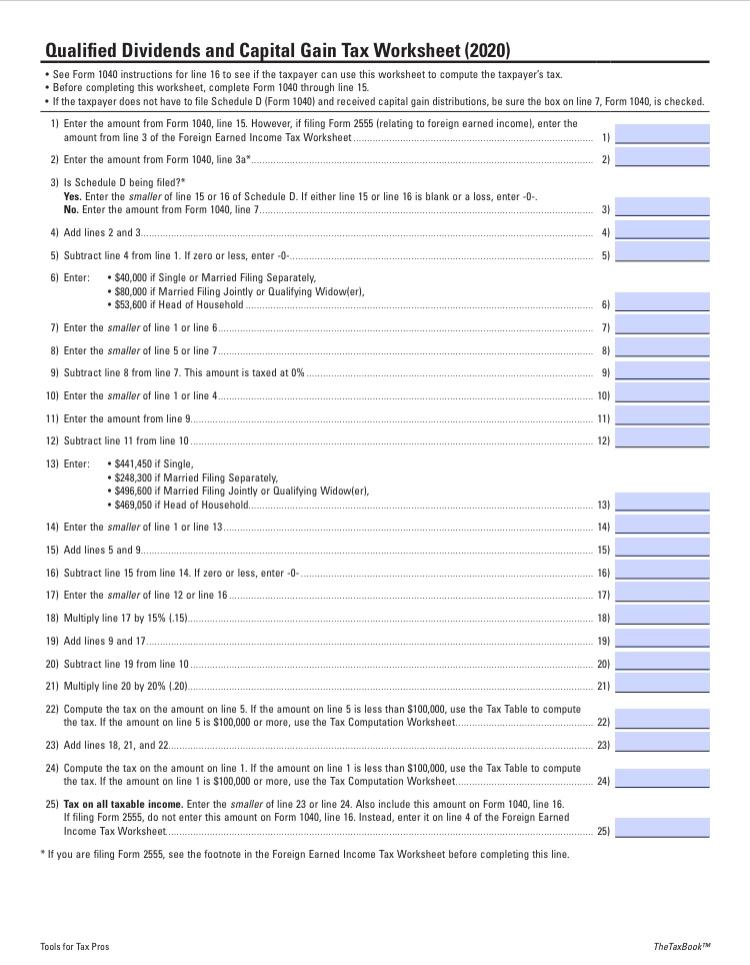

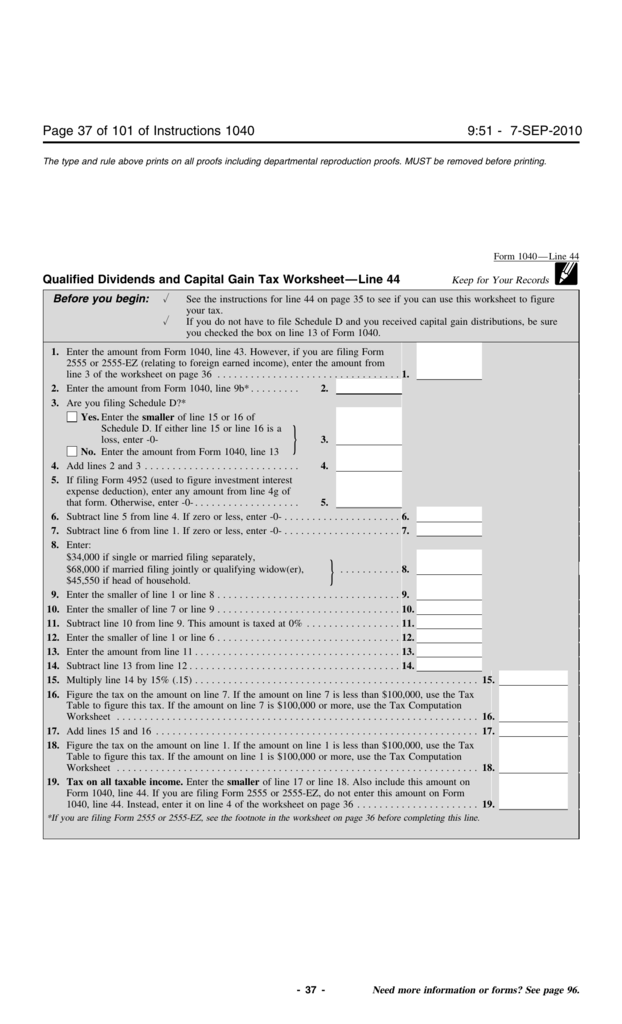

For tax year 2021 the 20 rate. Instead 1040 Line 44 Tax asks you to see instructions In those instructions there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet which is how you actually calculate your Line 44 tax. Capital gains and qualified dividends.

Fill in all of the requested fields they are marked in yellow. If the taxpayer does not have to file Schedule D Form 1040 and received capital gain distributions be sure. Schedule D Tax Worksheet If you have to file Schedule D and line 18 or 19 of Schedule D is more than zero use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040 line 44.

Qualified Dividends and Capital Gain Tax Worksheet. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Irs form qualified dividends and capital gain tax worksheet 2019.

2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET HRblock The 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET HRblock form is 1 page long and contains. Find the document template you need from our collection of legal form samples. When stocks real estate and other types of investments are sold for a profit – which means that they have earned the owners.

This article provides you with an overview of the Qualified Dividends Tax Worksheet and how it can be used to your advantage. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Ad Download or Email Form 1041sd More Fillable Forms Register and Subscribe Now.

Calculates a capital gain or capital loss for each separate capital. Irs 2019 qualified dividends and capital gain tax worksheet line 12a. Now working with a Qualified Dividends And Capital Gain Tax Worksheet 2019 takes a maximum of 5 minutes.

2020 Qualified Dividends And Capital Gains Worksheet. The information from Form 1099-DIV Dividends and Distributions and Form 1099-B Proceeds From Broker and Barter Exchange Transactions can easily be entered into the TaxAct program in the Investment Income section of the Federal QA or directly on the forms where applicable. Please show how the results from the Qualified Dividends and Capital Gain Tax worksheet are applied to the 1040 Forms.

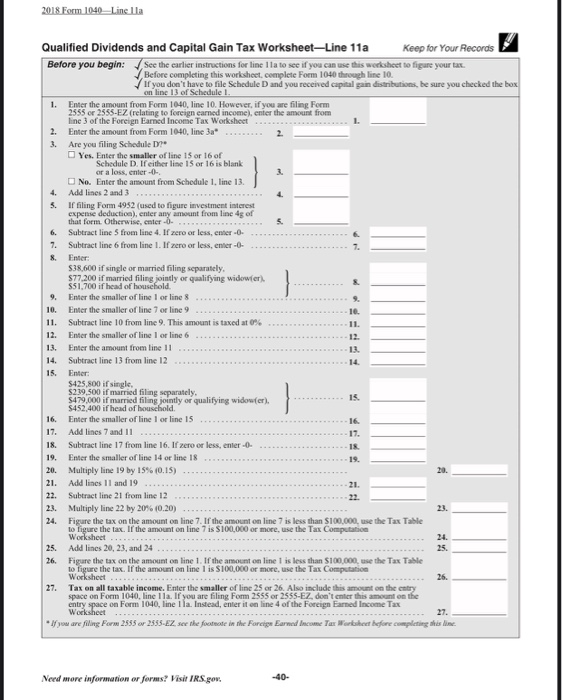

2019 Tax Computation WorksheetLine 12a k. Unrecaptured Section 1250 Gain Worksheet. Qualified Dividends and Capital Gain Tax WorksheetLine 11a.

Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR line 16 or in the instructions for Form 1040-NR line 16. 550 for more details. Difference Between Dematerialisation And Rematerialisation Sag Rta Electronic Forms Infographic Different Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf.

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf. The Qualified Dividends and Capital Gains Tax worksheet correctly calculates the 15 tax on these amounts but I cannot see how it is ever reflected on my 1040 return. Qualified Dividends and Capital Gain Tax Worksheet 2019 See Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayers tax.

Fill out securely sign print or email your qualified dividends tax worksheetpdffillercom 2015-2020 form instantly with SignNow. Before completing this worksheet complete Form 1040 through line 11b. The Tax Summary screen will then indicate if the tax has been computed on the Schedule D Worksheet or the.

For tax year 2019 the 20 rate applies to amounts above 12950. Unformatted text preview. The 27 lines because they are so simplified end up being difficult to follow what exactly they do.

Access IRS Tax Forms. Select the Get form key to open it and start editing. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends.

The 1040 form is treating all my qualified dividends and capital gains as taxable at ordinary rates. Qualified dividend and capital gain tax worksheet. Available for PC iOS and Android.

The 2019 Tax Computation WorksheetLine 12a form is 1 page long and contains. Exclusion of Gain on Qualified Small Business QSB Stock. Our state web-based blanks and clear guidelines eliminate human-prone errors.

Qualified Dividends And Capital Gain Tax Worksheet 2019 Irs. The maximum tax rate for long-term capital gains and qualified dividends is 20. Before completing this worksheet complete Form 1040 through line 10.

Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. Before completing this worksheet complete Form 1040 through line 10. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends and Capital Gain Tax Worksheet the Schedule D Tax Worksheet Schedule J Form 8615 or the Foreign Earned Income Tax Worksheet enter.

Complete Edit or Print Tax Forms Instantly. Qualified Dividends And Capital Gain Tax Worksheet Line 12a. Qualified Dividends and Capital Gain Tax Worksheet 2019.

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. And Capital Gain Tax Worksheet the Schedule D Tax Worksheet Schedule J Form 8615 or the Foreign Earned Income Tax. The 0 and 15 rates continue to apply to amounts below certain threshold amounts.

Names shown on return. To report a capital loss carryover from 2019 to 2020. The Line 44 worksheet is also called the Qualified Dividends and Capital Gain Tax Worksheet.

In C Please Create A Function To Certify The Chegg Com

Instructions Schedule Schedule 5 Qualified Dividends Chegg Com

Qualified Dividends And Capital Gain Tax Worksheet Line 44

Qualified Dividends And Capital Gain Tax Worksheet Chegg Com

Create A Function For Calculating The Tax Due For Chegg Com

2018 Qualified Dividends And Capital Gain Tax Worksheet Pdf Qualified Dividends And Capital Gain Tax Worksheet 2018 U2022 See Form 1040 Instructions For Course Hero

2011 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

Qualified Dividends And Capital Gain Tax Worksheet 2019 Fill Online Printable Fillable Blank Pdffiller

Qualified Dividends And Capital Gains Flowchart

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 Fill Online Printable Fillable Blank Pdffiller

2015 2021 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

Review Alexander Smith S Information And The W2 Chegg Com

Qualified Dividends And Capital Gain Tax Worksheet

2018 Instruction 1040 Pdf 2018 Form 1040 U2014line 11a Qualified Dividends And Capital Gain Tax Worksheet U2014line 11a Keep For Your Records Before You Course Hero

6 2 Final Project Two Qualified Dividends And Capital Gain Tax Worksheet Page 40 Of 117 Fileid Studocu

The Pictures In This Question Are As Visible As I Chegg Com

How Your Tax Is Calculated Understanding The Qualified Dividends And Capital Gains Worksheet Marotta On Money

Figure The Tax On The Amount On Line 7 If The Amount On Line 7 Is Less Than 100 000 Use The Tax Table To Figure The Tax If The Amount On Line